The First Home Guarantee 2025 brings major changes for Queensland buyers, including higher property caps, unlimited places and no income limits. Combined with state grants and stamp duty exemptions, these updates make entering the property market more achievable than ever. Find out more in this article.

The Brisbane real estate market has seen incredible gains over the last five years, with dwelling values increasing by more than 78%. As of August 2025, the media value of homes in Brisbane was an astonishing $936,000, and as Australia’s second most expensive capital, had an annual growth of $86,600.

This surge in value might be great for current homeowners, but it can make it more difficult for potential first home buyers to achieve their own dreams of home ownership. Luckily, with the recent First Home Guarantee changes, buying your first home in Queensland just got a whole lot easier.

On 1 October 2025, updates to the federal government’s First Home Guarantee (FHG) scheme came into effect. When you combine these changes with Queensland’s own grants and concessions, the path to home ownership for first home buyers is looking more accessible than it has in years.

So, what’s changing? And how does it impact you as a Queensland buyer?

The FHG is a federal initiative that is designed to help eligible buyers more easily purchase their first home. It does this by guaranteeing up to 15% of the property’s value. So instead of needing a full 20% deposit, eligible buyers need as little as a 5% deposit without triggering the need to purchase lender’s mortgage insurance (LMI).

This gives the buyers a boost while still protecting lenders as well.

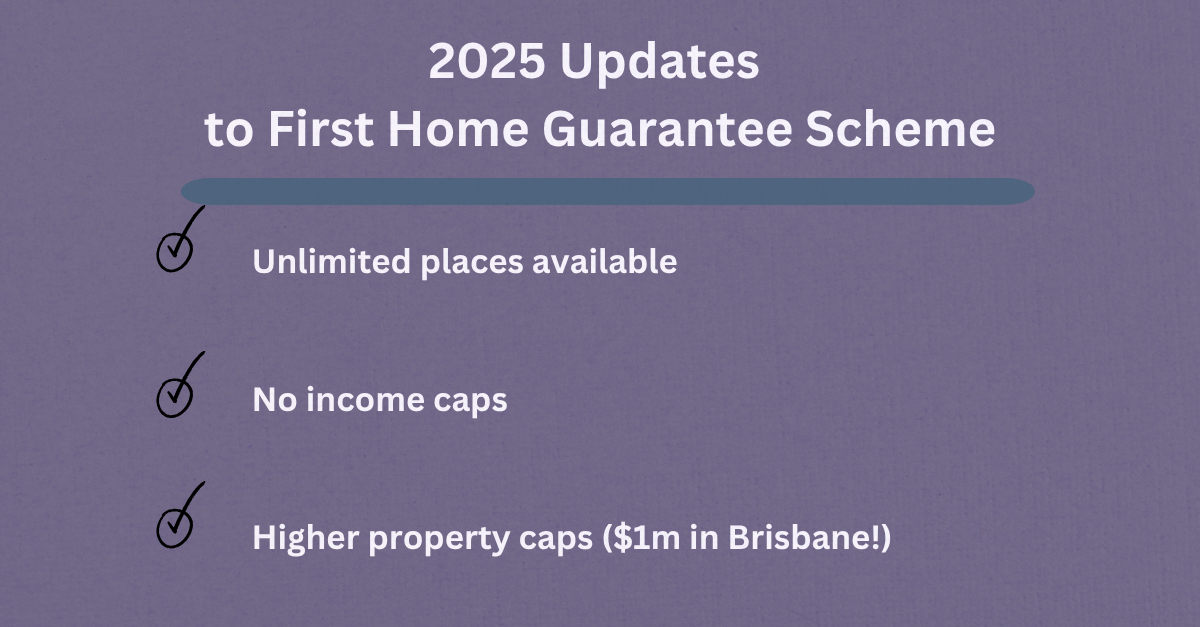

While the basic framework of the FHG has stayed the same, there have been updates to limits and caps that can make a big difference to potential home owners, including:

The updates to the FHG could significantly expand your options when it comes to buying home. That’s because homes in Brisbane, the Gold Coast and the Sunshine Coast (and elsewhere in Australia) that were previously out of reach of the FHG now may qualify.

The changes also mean that more Queenslanders will be eligible, since income is no longer a roadblock. And because there’s no limit to the amount of people that can take advantage of the scheme, you won’t miss out simply because places have already been filled.

While these all sound like great things, there are a few downsides to the changes. The biggest challenge is that competition is likely to heat up as well. With more buyers able to jump into the market with a smaller deposit, finding available housing and getting in before or above others looking to buy could be more difficult.

Our advice is to get organised early. Arrange your preapprovals and ensure you have the right support and advice first. Our team is on hand to help.

The federal scheme isn’t the only boost available to potential first home buyers. Queensland residents may also be eligible for:

These incentives – other than the Boost to Buy scheme – can be combined with the FHG. And this can be a substantial benefit for new home buyers. However, it’s important to remember that the FHG still requires a 5% deposit plus purchase costs, including stamp duty and other fees. Having clarity around these costs is a key part of your financial pre-planning. And it’s something your broker can help you map out from the start.

The Boost to Buy equity scheme may also be combined with the FHG, but we won’t know for certain until the rollout details have been confirmed next year.

The 2025 changes to the First Home Guarantee represent a major opportunity for Queensland first-home buyers. In fact, with higher property caps, unlimited places, no income restrictions and the state-based boosts available too, there’s never been a better time to plan your move.

That said, buying your first home is still a big financial commitment. While the government guarantee reduces the deposit you need, you’ll still need to budget for purchase costs like stamp duty, legal fees and moving expenses. Understanding these additional costs upfront, and how the different grans and concessions interact, this can make all the different to your long-term confidence and affordability.

At Stapleton Finance, we specialise in helping first-home buyers navigate the changing landscape of grants, guarantees and federal and state initiatives. If you’re ready to investigate buying your first home, get in touch with our team.

We’ll help you take advantage of all the opportunities available to you so you can get on the property ladder more easily than ever.

Read to take the first step? Contact our team today!

Experts believe that 2025 might be a good year to get in quick and buy a new home – particularly as a first home buyer. Interest rates are likely to decline somewhat. Though some areas are still growing, across Australia housing prices have decreased, for example, down 0.17 percent in December. Experts also believe that […]

Read MoreFor first home buyers in Queensland, there’s been some very good news in the property arena recently. This means that 2025 is shaping up to be a year of exciting opportunities. One of these is that recent changes to Queensland’s policies for first home buyers means you can now rent out a room in your […]

Read MoreHere at Stapleton Finance, one of our key goals is to get more Australians into their own homes sooner. The First Home Guarantee Scheme is one of the many valuable tools we have at our fingertips to support QLD first home buyers. But what is the First Home Guarantee Scheme and how can it help […]

Read More